Instant Download

Get Reseller Access

After Sale Support

Limited Time Offer

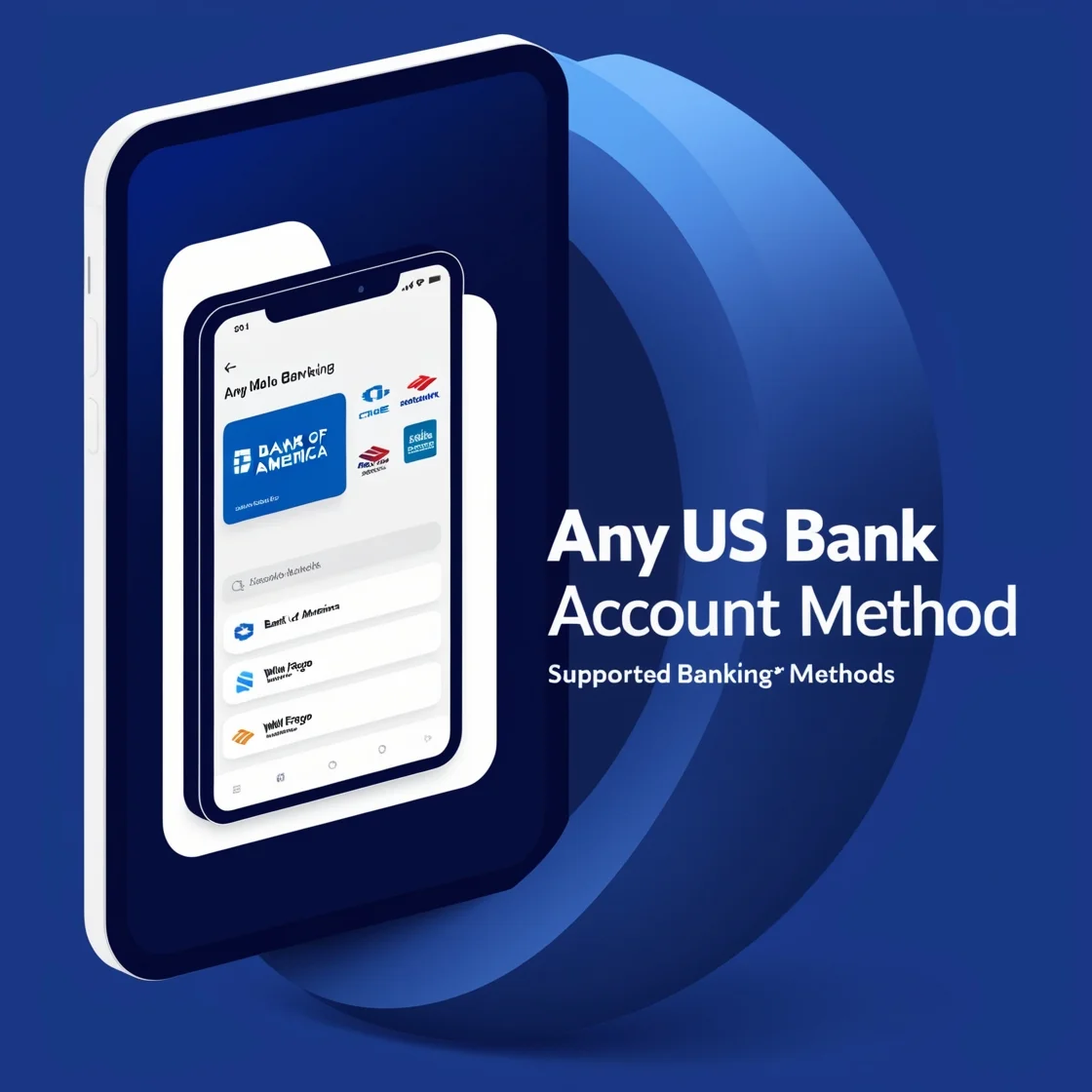

বাংলা ভাষায় বিস্তারিতভাবে জানুন কীভাবে ঘরে বসেই যেকোনো মার্কিন ব্যাংকে অ্যাকাউন্ট খুলবেন সহজ পদ্ধতিতে, ভেরিফিকেশনসহ সম্পূর্ণ গাইডলাইন।

৳ 599 Original price was: ৳ 599.৳ 299Current price is: ৳ 299.

Any US Bank Account creation method in Bangla

Instant Download

Get Reseller Access

After Sale Support

Limited Time Offer

বাংলা ভাষায় বিস্তারিতভাবে জানুন কীভাবে ঘরে বসেই যেকোনো মার্কিন ব্যাংকে অ্যাকাউন্ট খুলবেন সহজ পদ্ধতিতে, ভেরিফিকেশনসহ সম্পূর্ণ গাইডলাইন।

৳ 599 Original price was: ৳ 599.৳ 299Current price is: ৳ 299.

Description

How to Open a U.S. Bank Account – A Step-by-Step Guide

Opening a U.S. bank account is easier than you might think—even if you’re not a U.S. citizen. Whether for savings, business, or receiving international payments, a U.S. bank account can offer you safety, convenience, and financial advantages.

Why Open a U.S. Bank Account?

Having a U.S. bank account makes financial transactions smoother, especially for business owners, freelancers, or frequent travelers. Benefits include:

- Secure Transactions – FDIC-insured and protected.

- Credit Building – Helps U.S. residents or future immigrants build credit.

- Faster International Payments – Lower fees and faster transfers.

Types of Bank Accounts

- Checking Account – For daily use like purchases, transfers, and salary deposits.

- Savings Account – Ideal for long-term savings with interest.

- Certificate of Deposit (CD) – Fixed-term savings with higher interest.

What You Need to Apply

For U.S. Residents:

- Government-issued ID (Passport or Driver’s License)

- Social Security Number (SSN)

- Proof of address (e.g., utility bill)

For Non-Residents:

- Valid Passport

- U.S. Visa or entry document

- ITIN (If no SSN)

- Proof of foreign address

Note: Not all banks accept non-residents. Check individual bank policies.

How to Open a Bank Account

- Choose a Bank – Research options based on your status (resident or non-resident).

- Gather Documents – Prepare ID, proof of address, and SSN/ITIN.

- Pick Account Type – Select a checking, savings, or CD.

- Apply – Apply online (for residents) or visit a branch (for non-residents).

- Deposit Funds – Most banks require an initial deposit ($25–$100).

- Activate & Access Online Banking – Once approved, you can start managing your account digitally.

Best Banks for Non-Residents & International Use

- Chase – Easy mobile banking and large ATM network.

- Bank of America – User-friendly with low deposit requirements.

- Wells Fargo – Known for international-friendly services.

- HSBC – Great for global banking and foreign clients.

- Citibank – Wide global reach, perfect for managing finances across countries.

Tips for Non-Residents

- Try to get an ITIN if you don’t have an SSN.

- Choose banks known for accepting foreign clients (e.g., HSBC, Citibank).

- Be ready to apply in person at a U.S. branch.

Reviews

There are no reviews yet